The Commonwealth Fund recently reported that the U.S. continues to spend more on healthcare than other nations, and has the highest rate of people with multiple chronic conditions. Within this healthcare environment, many individuals are at risk of financial crises in part due to medical debt. MVC recently helped prepare a unique data set that linked its robust claims-based data with Experian’s commercial credit report data, resulting in an insightful analysis of the association between a patient’s chronic disease burden and their financial outcomes. The work was led by Nora Becker, M.D., Ph.D., and other colleagues from the U-M Institute for Healthcare Policy and Innovation, who published their analysis in JAMA Internal Medicine.

The financial burdens of illness can be due to the direct cost of medical care or the indirect effects of lost income due to illness. Many healthcare providers have first-hand anecdotes about patients who struggle to cover expenses necessary to manage their chronic condition, then avoid future healthcare services that lead to a worsening of their health or the development of additional chronic conditions. This negative feedback loop and the burden of medical debt are critical to understand so that healthcare leaders can adopt policies that improve financial outcomes for patients with chronic conditions.

Dr. Becker and her colleagues sought to understand the association between chronic disease diagnoses and adverse financial outcomes among commercially insured adults. Prior work in this area was limited, as researchers lacked data containing both clinical diagnoses and financial outcomes for the same individuals across a variety of chronic conditions. This time, however, MVC helped link patient data from its Blue Cross Blue Shield of Michigan (BCBSM) Preferred Provider Organization (PPO) claims to Experian credit data for the same patients’ financial histories. This data set was prepared for Dr. Becker and her colleagues, who performed the subsequent analysis and composed the resulting publication.

The 13 chronic conditions included in the analysis were selected for their prevalence, clinical importance, and association with financial challenges. These included cancer, congestive heart failure, chronic kidney disease, Alzheimer’s disease and other dementias, depression and anxiety, diabetes, hypertension, ischemic heart disease, liver disease, chronic obstructive pulmonary disease and asthma, serious mental illness, stroke, and substance use disorders.

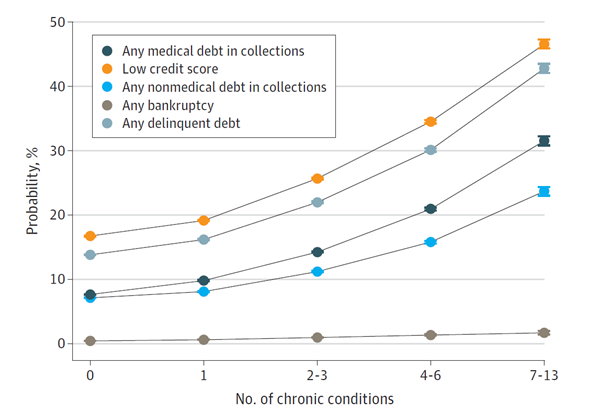

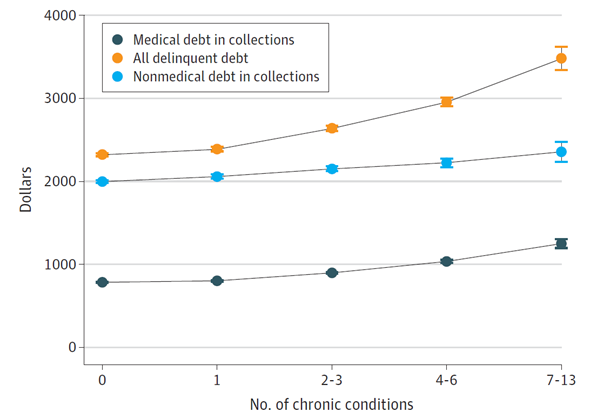

The results of the analysis demonstrated a strong association between a patient’s chronic disease burden and adverse financial outcomes. For instance, among individuals with no chronic conditions versus those with 7 to 13 chronic conditions, the estimated probabilities of having medical debt in collections (7.7% vs 32%), nonmedical debt in collections (7.2% vs 24%), a low credit score (17% vs 47%) or recent bankruptcy (0.4% vs 1.7%) were all considerably higher for patients managing more chronic conditions (see Figure 1), with notable increases in rates of adverse financial outcomes between patients with no chronic conditions and those with 2 to 3 conditions or 4 to 6 conditions. Furthermore, among individuals with non-zero amounts of debt, the amount of debt increased as the number of diagnosed chronic conditions increased (see Figure 2). For instance, the adjusted dollar amount of medical debt increased by 60% from $784 for individuals with no chronic conditions to $1252 for individuals with 7 to 13 chronic conditions.

Figure 1. Predicted Probability of Credit Outcomes by Number of Chronic Conditions

Figure 2. Average Debt Among Individuals with Nonzero Debt by the Number of Chronic Conditions

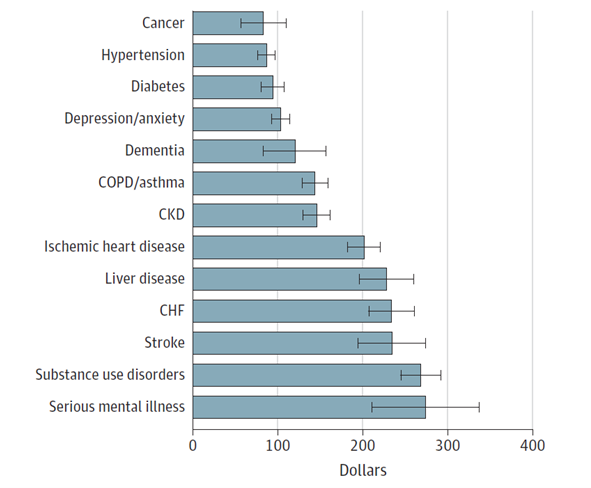

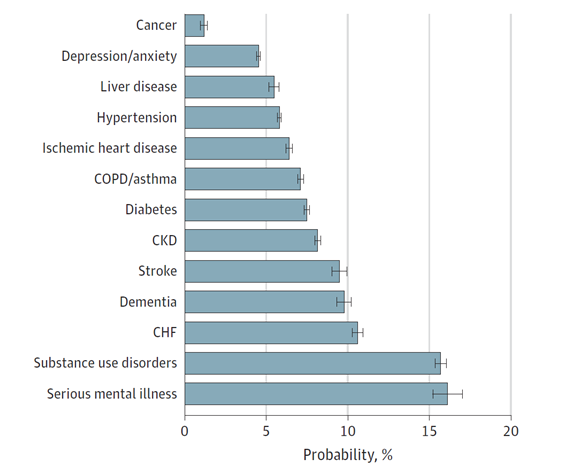

In addition to finding an almost dose-dependent association between adverse financial outcomes and the presence of multiple chronic diseases, the analysis examined which conditions had the highest dollar amount of debt for the 10% of patients with medical debt in collections (see Figure 3). Congestive heart failure, stroke, substance use disorders, and serious mental illness racked up the most debt. Additionally, the probability of having medical debt in collections was substantially higher for patients managing serious mental illness or substance use disorders (see Figure 4).

Figure 3. Estimated Increase in Dollar Amount of Medical Debt in Collections by Type of Chronic Condition Among Individuals with Nonzero Medical Debt in Collections

Figure 4. Estimated Increase in the Probability of Having Medical Debt in Collections by Type of Chronic Condition

“We were expecting an association between adverse financial outcomes and chronic disease burden, but we were really struck by the magnitude and strength of the association that we found,” said Dr. Becker. “To see such a large increase in rates of adverse financial outcomes by chronic conditions really emphasizes that there is a crisis of financial instability among individuals with high chronic disease burden.”

Such significant variation across chronic conditions could be the result of several factors, such as some conditions requiring more costly treatments and high out-of-pocket expenses, and others making it more likely that patients miss work or cannot stay employed. The implications of such findings are impressive given the already high rate of patients with multiple chronic conditions—4 in 10 adults in the U.S. have more than one chronic condition—and the fact that poorer financial health is linked to more forgone medical care, worse physical and mental health, and greater mortality. Chronic conditions are already the leading causes of death and disability as well as the leading drivers of America’s $4.1 trillion in annual healthcare costs.

Dr. Becker and her colleagues were clear that their analysis did not determine causality—it is still unknown whether poor financial health leads to the development of chronic conditions or vice versa. Therefore, they advocated for the value of further analyses to determine underlying causes, which would inform how to approach improvements. The authors offered that if poor financial health causes additional chronic disease, then new social safety-net policies intended to reduce poverty rates may be beneficial. If chronic diseases are leading to poorer financial outcomes, then changes to the design of commercial insurance benefits could provide additional protections from medical expenses for costly chronic conditions.

“Additional work to determine the causal mechanisms of this association is crucial,” said Dr. Becker. “If we don’t figure out why this association exists, and who is most vulnerable, we can’t hope to design social policies to help protect patients from adverse financial outcomes.”

One of MVC’s core strategic priorities is intentional partnerships with fellow Collaborative Quality Initiatives (CQIs) and quality improvement collaborators. In the future, MVC hopes to do more with commercial credit report data given its unique uses and implications. It is the Coordinating Center’s hope that this work will help identify at-risk populations, understand how economic instability affects health outcomes, and generate insights that help working-age adults recover and return to work after major health events. The MVC team will continue exploring uses for this data in 2023 and engage its partner CQIs and collaborators to identify additional reporting opportunities for members.

As was recently highlighted in MVC’s 2022 Annual Report, MVC contributed to several other projects in the last 12 months similar to the analysis completed by Dr. Becker and her colleagues. MVC data and expertise also contributed to projects that resulted in new condition and report development, return on investment estimations for various healthcare initiatives, and additional insights on care delivery and patient outcomes. MVC will continue to identify partnerships and projects that leverage its rich data to achieve more sustainable, high-value healthcare in Michigan.

Publication Authors

Nora V. Becker, MD, PhD; John W. Scott, MD, MPH; Michelle H. Moniz, MD, MSc; Erin F. Carlton, MD, MSc; John Z. Ayanian, MD, MPP

Full Citation

Becker NV, Scott JW, Moniz MH, Carlton EF, Ayanian JZ. Association of Chronic Disease With Patient Financial Outcomes Among Commercially Insured Adults. JAMA Intern Med. 2022; 182(10): 1044–1051. doi:10.1001/jamainternmed.2022.3687.